Fidelity Digital Assets has released a report emphasizing the crucial adjustments Bitcoin miners must undertake to sustain their positions in the aftermath of the network’s halving event. The halving, which slashes the reward for mining Bitcoin by 50%, is celebrated by Bitcoin holders for its potential to drive up the cryptocurrency’s price. However, it presents significant challenges for miners, who must meticulously prepare to avoid bankruptcy.

Navigating Post-Halving Challenges

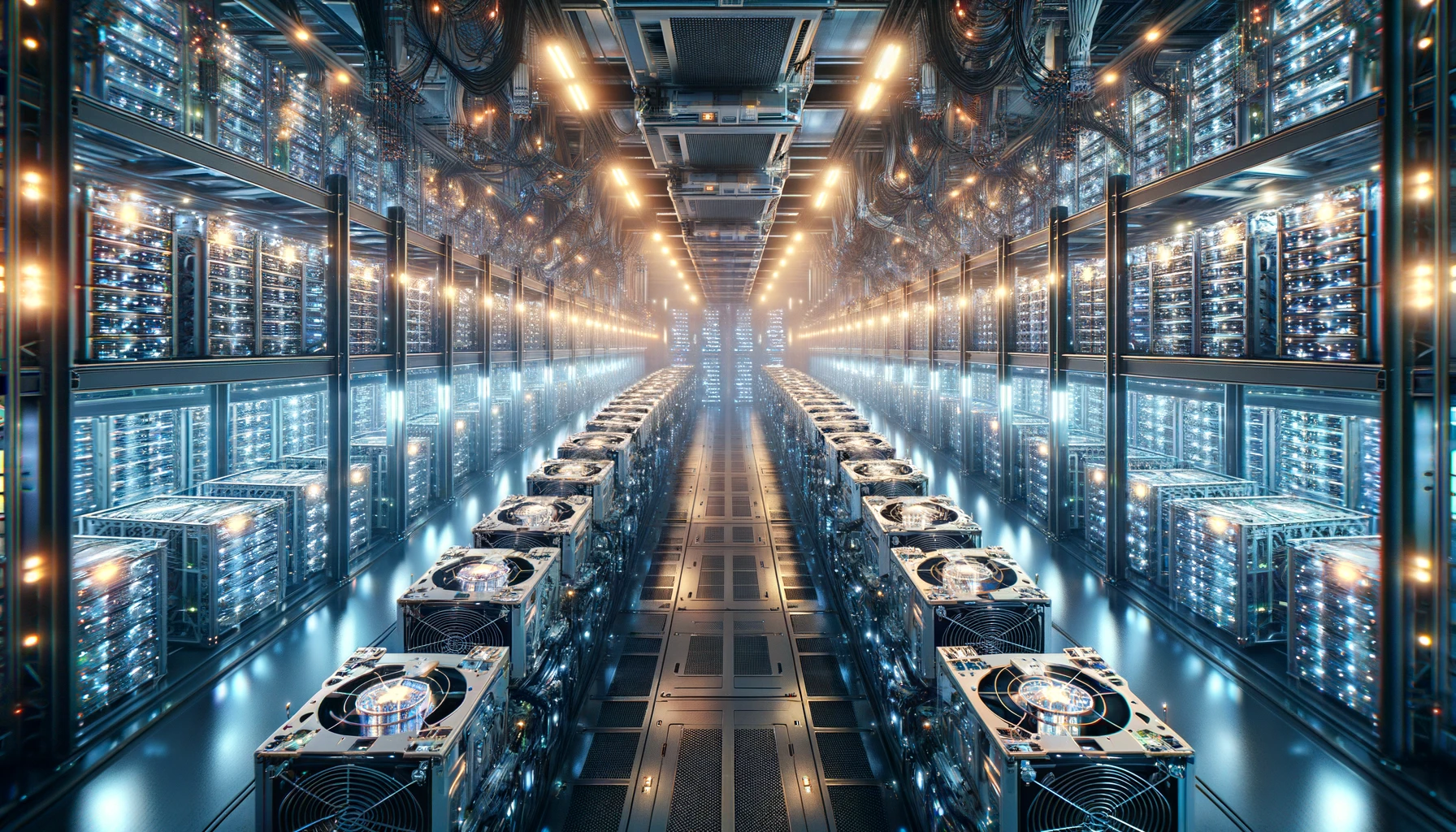

The report points out that maintaining the status quo is not sufficient for miners who wish to remain competitive. They are advised to not only preserve their current hash rate, energy sources, and real estate but also to vie for these resources against the entire network, which is engaged in the same battle. “Miners need to be proactive and cannot afford to just maintain their position in the network,” stated Daniel Gray, an analyst at Fidelity Digital Assets.

Strategic Moves for Miners

To counteract the reduced earnings post-halving, miners are encouraged to:

- Continuously seek ways to increase their hash rate and the efficiency of their operations.

- Source lower-cost energy to reduce operational expenses.

- Expand their infrastructure to accommodate new machinery.

The period following a halving is described as particularly challenging due to the immediate impact on miners’ revenues. Miners are advised to have capital reserves ready to bridge the gap during the time it takes for Bitcoin’s value to adjust to the reduced supply of new coins.

Evolution of the Bitcoin Protocol

Fidelity’s report also hints at the potential evolution of the Bitcoin protocol, suggesting that new layers and use cases could emerge, attracting more users to the ecosystem. Such developments could further solidify the network’s resilience and the industry’s capacity to recover and grow stronger after each halving event.

Industry Resilience and Recovery

Historically, halving events have led to a shakeout of less efficient miners, but the industry has always bounced back stronger. “While the past halvings did see a flush-out of weaker miners, the industry ultimately recovered with more miners and hash rate than ever, demonstrating the resiliency of the network and industry,” the report concludes.

As Bitcoin continues to mature and its ecosystem expands, miners will play a pivotal role in maintaining the network’s security and processing transactions. Their ability to adapt to the economic shifts brought about by halving events will be critical in ensuring the long-term stability and growth of the Bitcoin network.