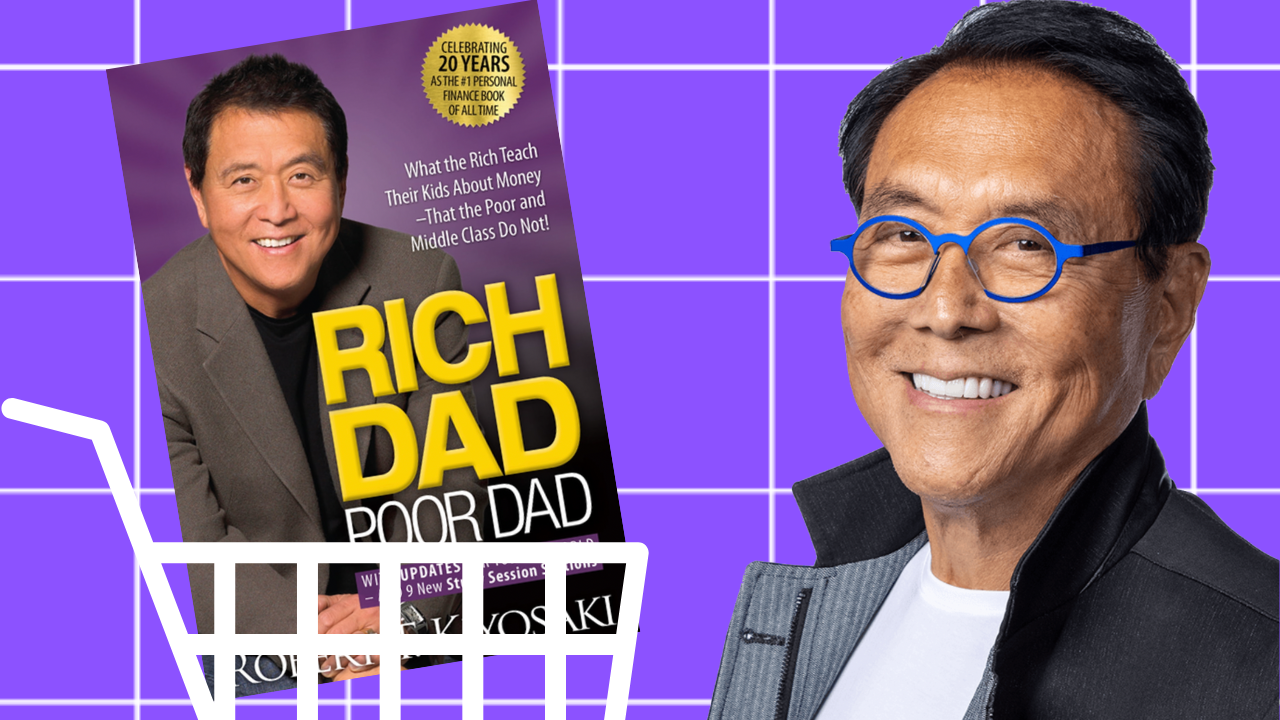

Robert Kiyosaki, the financial educator behind the bestselling book Rich Dad Poor Dad, has made a striking forecast: Bitcoin could soar past $1 million by 2035. His prediction arrives as he sounds the alarm over what he calls an impending “Greater Depression” in the United States.

Warning Signs of Economic Collapse

In a recent post on X (formerly Twitter), Kiyosaki painted a bleak picture of America’s economic future. He pointed to soaring credit card debt, mounting national debt, rising unemployment, and shrinking retirement savings as key red flags.

He wrote, “In 2025, credit card debt is at all-time highs. US debt is at all-time highs. Unemployment is rising. 401(k)s are losing. Pensions are being stolen. The USA may be heading for a GREATER DEPRESSION.”

These concerns aren’t new for Kiyosaki. He’s long urged investors to protect their wealth by turning to hard assets like gold and silver. Now, he places Bitcoin in that same category, calling it “digital gold.”

Why Bitcoin?

Kiyosaki sees Bitcoin as a shield against inflation and systemic economic risks. His stance reflects a broader shift among investors looking to diversify away from traditional markets.

Here’s why Bitcoin is gaining traction as a hedge:

- It’s decentralized, meaning it’s not controlled by any government or central bank.

- The supply is limited to 21 million coins, enhancing scarcity.

- Major institutions are beginning to adopt it, increasing legitimacy and demand.

- Recent ETF inflows and the latest Bitcoin halving event have tightened supply.

As of now, Bitcoin is trading near $85,000. Despite global economic uncertainty, it has held strong—thanks largely to increased institutional interest and a positive macroeconomic narrative.

Other Bold Predictions in the Crypto Space

Kiyosaki isn’t alone in his bullish outlook. Cathie Wood, CEO of Ark Invest, has forecasted that Bitcoin could hit $1.5 million by 2030. She cites growing institutional adoption and Bitcoin’s rising role as a digital store of value as key drivers.

While Kiyosaki’s $1 million target might seem far-fetched, it echoes a growing belief that Bitcoin could be a lifeline amid worsening financial conditions. With fears of economic instability rising, more investors are seeking refuge in decentralized, deflationary assets.