The financial markets experienced a dramatic shift on Friday, triggered by escalating geopolitical tensions in the Middle East. This unsettling development steered investors away from typically volatile assets like cryptocurrencies and stocks, favoring the relative safety of the U.S. dollar. Even traditional safe havens such as gold and U.S. Treasuries weren’t spared in the sell-off.

A Rollercoaster Day for Gold and Cryptos

Gold initially soared to a record-breaking high of over $2,431 per ounce in early trading. However, the luster didn’t last as the day progressed. Heightened communications between Israel, the U.S., and Iran added to market anxieties, causing gold to plummet by 3.75% to $2,340 by the afternoon.

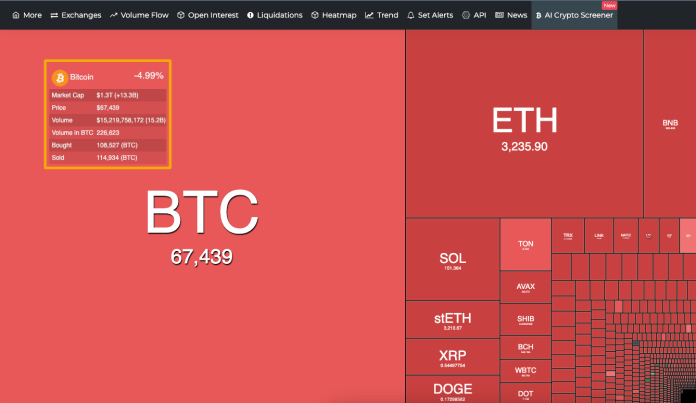

Concurrently, the cryptocurrency market faced a severe downturn. Bitcoin, after maintaining a stable price above $70,500 throughout the morning, faced a sharp decline. By afternoon, it had dropped by 8.1%, hitting a low of $65,150. Although it slightly recovered to $67,000 due to some dip buying, the damage was significant across the board.

Severe Impact on Market Positions

The sudden market movement wasn’t just a paper loss but had real consequences in the derivatives market. The past 24 hours saw massive liquidations, with long positions worth approximately $700 million wiped out, alongside $90 million in short positions.

By the close of trading, Bitcoin was down 4.99% at $67,439. Major U.S. stock indices like the S&P, Dow, and Nasdaq also ended the day lower, registering declines of 1.46%, 1.24%, and 1.62% respectively.

Altcoins, in particular, faced a brutal sell-off, with none spared except Ontology (ONT), which managed a modest gain of 3%. Core (CORE), SATS (1000SATS), and Zeta Chain (ZETA) were among the hardest hit, with losses exceeding 25%.

Crypto Analysts Weigh In

Despite the tumult, some market analysts provided a sliver of hope. Notably, il Capo of Crypto had forecasted a potential market shakeout of 15%-25% earlier in the day. His predictions held true as Bitcoin and other altcoins suffered steep losses. He later advised caution, suggesting investors wait and see how the market stabilizes at the extreme ends of its range.

Despite the pessimism, some like Michaël van de Poppe of MN Trading suggested that the bull cycle might still have room to run, influenced in part by the recent introduction of spot BTC ETFs.