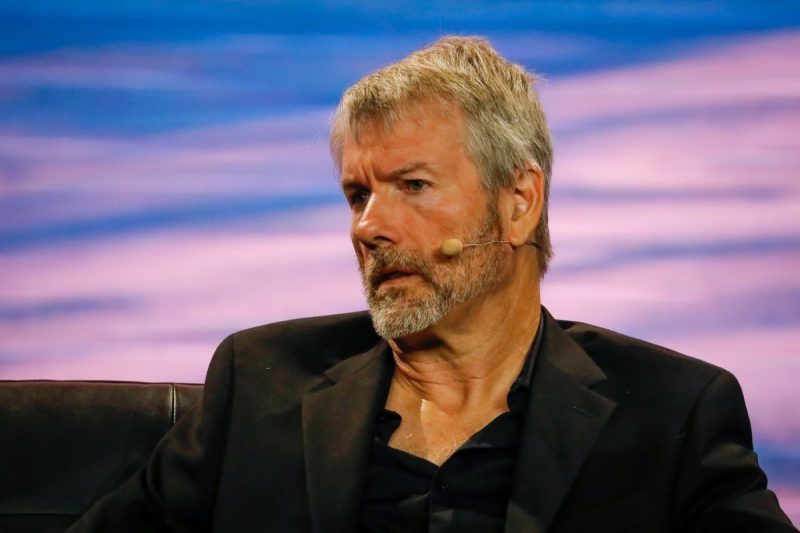

Microstrategy’s Executive Chairman, Michael Saylor, has positioned Bitcoin as the pinnacle of asset classes, asserting its dominance over traditional investments like gold and real estate due to its technical advantages. In a recent Bloomberg interview, Saylor articulated his belief that capital will continue to migrate from these conventional asset classes into Bitcoin, which he regards as an unparalleled store of value.

Bitcoin’s Unmatched Potential

Saylor’s confidence in Bitcoin stems from its emerging status as a trillion-dollar asset class, setting it apart from leading tech giants and traditional investment vehicles. He argues that Bitcoin’s structure allows it to potentially absorb trillions of dollars in capital, far exceeding the capacity of conventional asset classes. This unique characteristic positions Bitcoin not just as an investment but as a revolutionary financial entity capable of competing with and surpassing the value of gold, the S&P Index, and real estate markets.

Institutional Capital’s Gateway to Bitcoin

Highlighting the impact of spot bitcoin exchange-traded funds (ETFs), Saylor views these financial products as critical channels for institutional capital into the bitcoin ecosystem. The demand for these ETFs, according to Saylor, significantly outstrips the daily supply from miners, indicating a robust and growing interest in bitcoin investment. This influx of institutional capital is seen as a key driver in the digital transformation of capital, facilitating a seamless transition from traditional financial systems to the digital economy.

Microstrategy’s Long-term Bitcoin Strategy

Despite the availability of new investment avenues and the potential for profit-taking, Saylor remains steadfast in his commitment to Bitcoin. He dismisses the notion of selling Microstrategy’s Bitcoin holdings, emphasizing the strategic decision to view Bitcoin as the ultimate exit strategy. This approach underlines a broader vision where Bitcoin is seen not just as an asset but as a transformative economic force capable of reshaping the landscape of global finance.

Microstrategy’s Bitcoin Holdings

With an impressive portfolio of 190,000 bitcoins, Microstrategy has redefined its corporate identity around its bitcoin strategy, branding itself as the world’s first Bitcoin development company. This bold stance reflects a deep-seated belief in Bitcoin’s value proposition and its role in fostering technological innovation and value creation within the digital economy.