In a bold move that underscores its confidence in digital assets, MicroStrategy Inc., a leading global provider of business intelligence, mobile software, and cloud-based services, has made a significant addition to its cryptocurrency portfolio by purchasing an additional 12,000 bitcoins. Valued at approximately $821 million, this acquisition further cements MicroStrategy’s position as one of the most prominent corporate investors in Bitcoin.

A Strategic Investment in Digital Assets

Since its initial investment in Bitcoin back in August 2020, MicroStrategy has consistently increased its holdings in the cryptocurrency, viewing it as a reliable store of value and an attractive investment asset with more long-term appreciation potential than cash. The latest purchase brings MicroStrategy’s total Bitcoin holdings to an impressive figure, highlighting the company’s unwavering belief in the cryptocurrency’s value proposition.

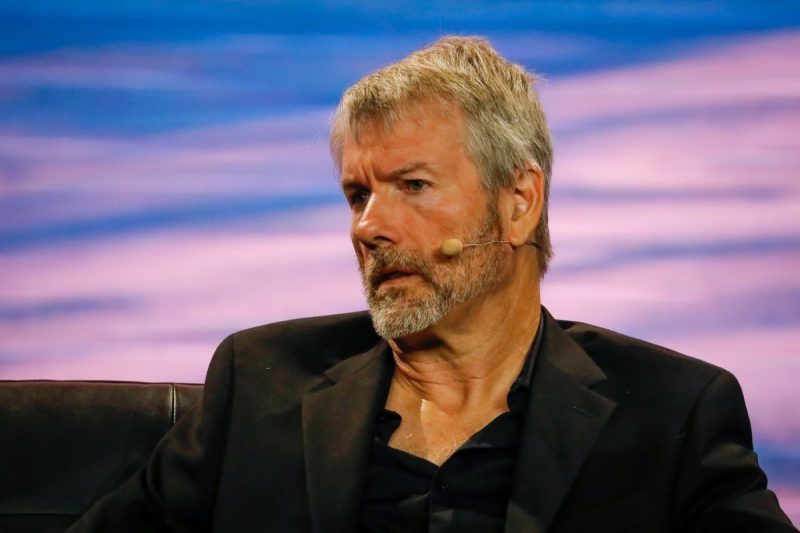

CEO’s Vision

Michael Saylor, the CEO of MicroStrategy, has been a vocal proponent of Bitcoin, advocating for its benefits as a digital gold and a hedge against inflation. Under his leadership, MicroStrategy has pursued a strategy of utilizing Bitcoin as a primary treasury reserve asset. Saylor’s enthusiasm for Bitcoin is evident in his public statements and social media activity, where he frequently discusses the cryptocurrency’s advantages and potential for widespread adoption.

Market Reaction

The announcement of MicroStrategy’s additional Bitcoin purchase was met with mixed reactions in the cryptocurrency market. While some investors view the company’s aggressive accumulation of Bitcoin as a positive signal for the cryptocurrency’s future, others are concerned about the potential risks associated with such a concentrated investment in a highly volatile asset.

Implications for the Cryptocurrency Sector

MicroStrategy’s continued investment in Bitcoin is not just a testament to its confidence in the digital currency but also serves as a significant endorsement that could encourage other corporations to consider cryptocurrency investments as part of their treasury management strategies. As more companies explore the potential of digital assets, the cryptocurrency market could see increased institutional participation, which may contribute to greater stability and maturity of the sector.

Looking Ahead

The strategic move by MicroStrategy to bolster its Bitcoin holdings reflects its commitment to investing in digital assets as a core component of its corporate strategy. While the volatile nature of cryptocurrencies presents risks, the company’s leadership is clearly banking on the long-term growth potential of Bitcoin. As MicroStrategy continues to navigate the complex landscape of digital assets, its actions will likely remain a closely watched barometer for institutional interest in cryptocurrencies.