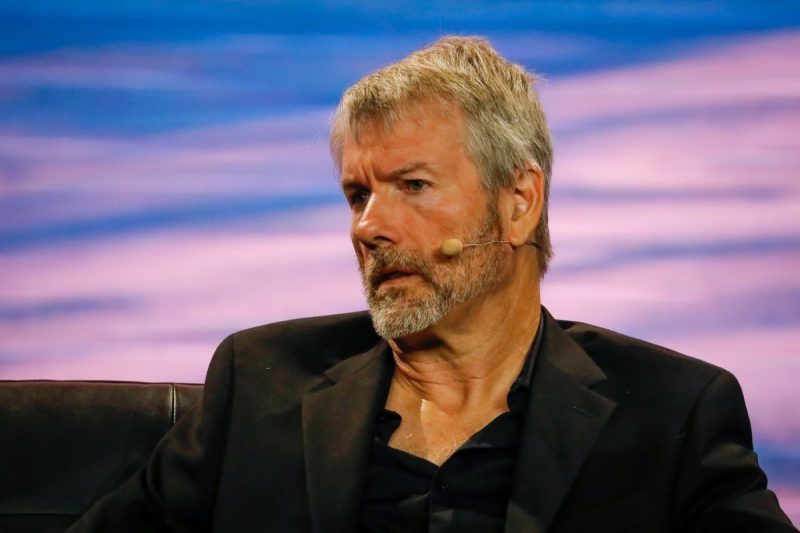

Bitcoin advocate and MicroStrategy founder Michael Saylor has unveiled a bold proposal for a US Digital Assets Framework. The plan, introduced on Dec. 21, suggests creating a Bitcoin reserve that he claims could generate up to $81 trillion for the US Treasury, strengthening the dollar and addressing the country’s growing national debt.

A Strategic Bitcoin Reserve to Offset Debt

Saylor’s proposal argues that establishing a national Bitcoin reserve could significantly benefit the US economy. According to him, such a reserve could create wealth between $16 trillion and $81 trillion while providing a strategy to neutralize the national debt.

“A strategic digital asset policy can strengthen the US dollar, neutralize the national debt, and position America as the global leader in the 21st-century digital economy,” Saylor wrote in an X (formerly Twitter) post.

MicroStrategy, under Saylor’s leadership, has acquired over 439,000 Bitcoin, currently valued at over $41 billion. Despite this, Saylor’s previous pitch to Microsoft about investing in Bitcoin was reportedly rejected by its shareholders.

Key Elements of the Digital Assets Framework

Saylor’s framework identifies six categories of digital assets:

- Digital Commodities (e.g., Bitcoin)

- Digital Securities

- Digital Currencies

- Digital Tokens

- Non-Fungible Tokens (NFTs)

- Asset-Backed Tokens

The framework seeks to define clear roles for issuers, exchanges, and owners, assigning specific rights and responsibilities while emphasizing ethical practices—stating no participant should “lie, cheat, or steal.”

Additionally, the proposal outlines a compliance system focused on cost efficiency. It suggests capping compliance costs at 1% of assets for token issuance and 0.1% annually for maintenance. This industry-driven approach prioritizes innovation and efficiency over bureaucratic hurdles.

Aiming for a Global Digital Economy Renaissance

The proposed framework also envisions a transformative impact on global markets, aiming to:

- Expand digital capital markets from $2 trillion to $280 trillion, with US investors capturing a majority of this wealth.

- Dramatically reduce asset issuance costs from millions of dollars to thousands, opening market access to 40 million businesses from the current 4,000 public companies.

- Cement the US dollar’s position as the global reserve digital currency.

Saylor believes this plan could spark a “21st-century capital markets renaissance,” unlocking trillions in value creation and positioning the US as a global leader in digital finance.

Mixed Reactions to Saylor’s Proposal

While Saylor’s ideas have attracted attention, they have also faced criticism. Bitcoin skeptic Peter Schiff dismissed the proposal as “complete bullshit,” arguing it would weaken the dollar, worsen national debt, and damage America’s global reputation.

Despite the backlash, MicroStrategy continues to lead corporate Bitcoin adoption, with its holdings currently reflecting a 54% aggregate profit, according to SaylorTracker.