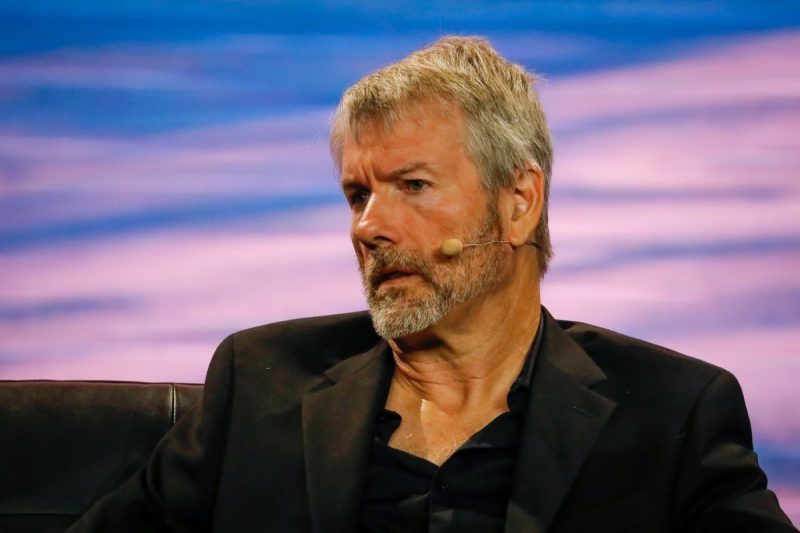

Bitcoin has once again reached the $60,000 mark, drawing attention from MicroStrategy chairman and co-founder Michael Saylor. In a tweet, Saylor remarked, “Bitcoin is the bridge from chaos to hope,” sharing a Fox Business clip comparing Bitcoin’s performance with other major assets over the past decade.

Bitcoin’s Performance Amid Economic Uncertainties

The Fox Business clip highlighted that Bitcoin outperformed major assets in eight of eleven instances between 2013 and 2023. This strong performance amidst global economic uncertainties has driven investors towards alternative assets like Bitcoin. Despite recent volatility influenced by events such as the Mt. Gox incident, the German government’s Bitcoin sales, and potential high U.S. borrowing costs, Bitcoin has rebounded. Buyers have capitalized on the dips, demonstrating renewed confidence in the cryptocurrency.

Also Read: Spot Ethereum ETF Approval Could Benefit Bitcoin: Michael Saylor

Recent events, such as the failed assassination attempt on former President Donald Trump, have also contributed to the crypto market’s recent surge. This turmoil has added to the appeal of Bitcoin as a safe-haven asset during times of political instability.

Influx of Capital into Bitcoin ETFs

Concerns initially arose about outflows from U.S. exchange-traded funds (ETFs). However, a net $737.5 million was added to 11 ETFs over four days leading up to Thursday. This influx of capital, combined with recent events, has helped push Bitcoin’s price to its current $60,000 level.

The resurgence of Bitcoin to the $60,000 mark highlights its resilience and attractiveness to investors during uncertain times. Michael Saylor’s optimism reflects a broader sentiment in the market, as Bitcoin continues to be viewed as a robust alternative asset. The combination of economic uncertainties, political events, and substantial capital inflows into Bitcoin ETFs underscores the dynamic and multifaceted factors driving Bitcoin’s latest rally.