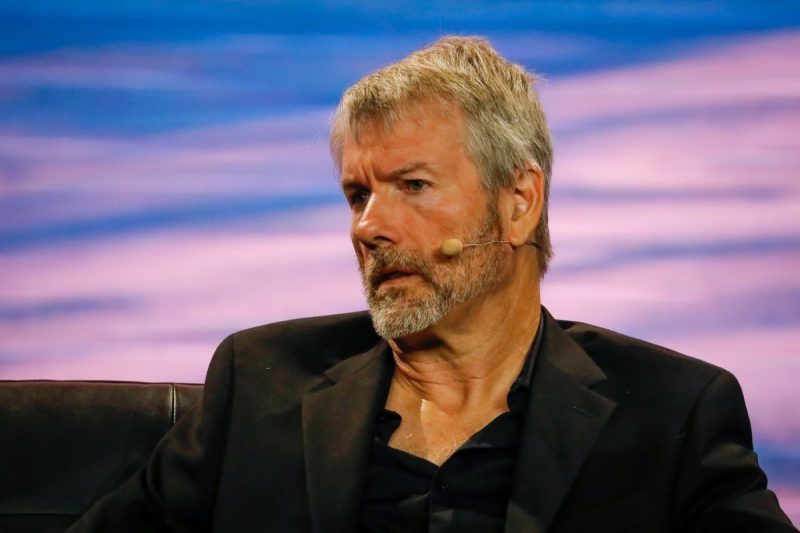

Michael Saylor, the executive chairman of MicroStrategy, has started a four-month plan to sell $216 million of his company shares. He disclosed this process in a filing with the U.S. Securities and Exchange Commission on January 2. Saylor had been awarded 315,000 stock options in April 2014, which are set to expire by April 30, 2024. His first sale involved 5,000 shares.

During MicroStrategy’s third-quarter earnings call on November 2, Saylor had revealed his strategy to sell daily tranches of 5,000 shares over the next four months. He mentioned that the proceeds from these sales would help him meet personal obligations and increase his Bitcoin investment. Saylor emphasized that despite these sales, his stake in MicroStrategy’s equity remains substantial.

The SEC filing dated November 1 indicated that Saylor is permitted to sell up to 400,000 shares of his vested options between January 2 and April 26, 2024.

In the context of cryptocurrency market performance, Bitcoin saw a significant rally last year, increasing by 170%. However, MicroStrategy’s performance surpassed this, achieving a 411% gain.

On December 27, MicroStrategy further solidified its Bitcoin investment by purchasing an additional 14,620 Bitcoins for $615 million. This acquisition increased the company’s total Bitcoin holdings to an impressive 189,150 Bitcoins, valued at approximately $8.5 billion.