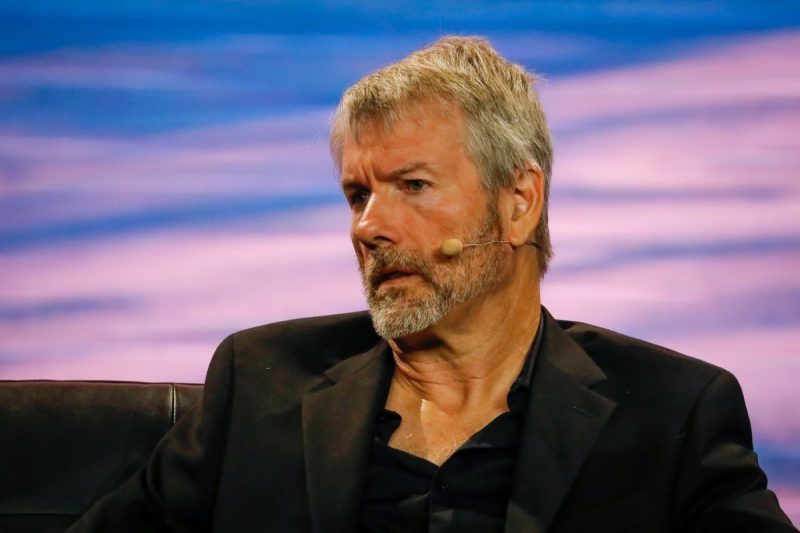

MicroStrategy founder Michael Saylor has reversed his stance on Bitcoin self-custody following criticism from the crypto community. In a recent interview, Saylor had advocated for entrusting Bitcoin to large financial institutions, sparking outrage among self-custody proponents. Now, he’s clarifying his position, stating that he supports self-custody for those “willing and able” and believes in the freedom to choose custodial options globally.

Saylor Faces Pushback After Endorsing Big Bank Custody

Saylor’s initial comments came during an Oct. 21 interview where he suggested that Bitcoin holders should trust “too big to fail” banks as custodians of their assets. He also criticized what he called “paranoid crypto-anarchists,” further fueling the controversy. Among his critics was Ethereum co-founder Vitalik Buterin, along with other key figures in the Bitcoin community.

Saylor’s remarks sparked a wave of backlash, with many in the crypto world viewing his endorsement of centralized banking as contradictory to Bitcoin’s decentralized principles. Dash marketer Joel Valenzuela called Saylor’s reversal “capitulation,” while Max Keiser, a prominent Bitcoin advocate, said his comments supported legacy financial institutions that Bitcoin aims to disrupt.

Saylor Clarifies His Position on Self-Custody

On Oct. 23, Saylor took to X (formerly Twitter) to clarify his stance, emphasizing that he supports both self-custody and the freedom for individuals and institutions to choose their custodial solutions. He also stressed that Bitcoin benefits from investment by all types of entities, whether they choose self-custody or trust a third-party custodian.

His follow-up post appeared to smooth over some of the backlash, with VanEck adviser Gabor Gurbacs noting that Saylor’s updated position should be “common sense.” However, others in the crypto community remained skeptical of Saylor’s intentions, questioning his alignment with decentralized ideals.

The Debate Around Self-Custody

The debate over self-custody versus third-party custody is a critical issue within the crypto world. Self-custody allows individuals to maintain full control over their assets but comes with risks, including potential security breaches. For instance, Pascal Gauthier, CEO of hardware wallet manufacturer Ledger, noted during a blockchain event in Dubai that there’s “no crypto without self-custody.” Gauthier, however, acknowledged the challenges, pointing to Ledger’s 2020 data breach, which exposed customer details and led to phishing attacks.

As the crypto space continues to evolve, the question of who should hold custody of digital assets remains at the forefront of discussions. Saylor’s reversal highlights the tension between decentralization advocates and those who believe institutional custody can bring more stability and mainstream adoption to Bitcoin.