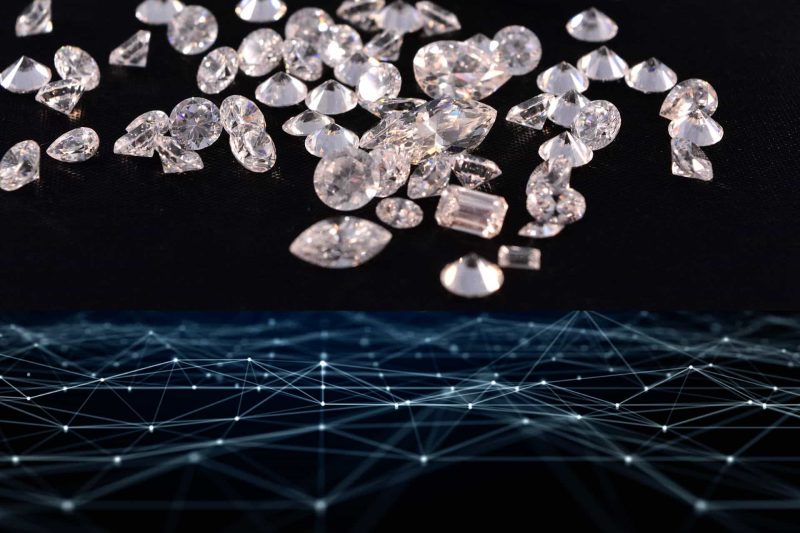

In an innovative leap for the cryptocurrency industry, diamonds have become the latest asset to undergo the transformative process of tokenization. This move places these precious stones on the blockchain, offering a new, digitized form of investment. Sponsored by Diamond Standard Commodities and Horizon Kinetics, and facilitated by the crypto securities trading platform Oasis Pro, a new token representing a stake in the Diamond Standard Fund has been created on the Avalanche C-Chain.

A Milestone in Asset Tokenization

Cormac Kinney, founder and CEO of Diamond Standard, highlighted the significance of this development, stating, “For the first time in history, Diamond Standard and Oasis Pro are making an approximately $1.2 trillion natural resource accessible to investors via a more convenient, tradable fund.” This initiative not only democratizes access to a historically exclusive asset class but also integrates it into the modern, digital economy.

The Rise of Real-World Asset Tokenization

The tokenization of real-world assets (RWAs) – the process of converting traditional assets like gold, credit, and bonds into blockchain-based tokens – has seen increased adoption over the past year. Notably, financial powerhouses such as Franklin Templeton, HSBC, and BlackRock have explored or launched tokenization projects, with BlackRock recently unveiling a tokenized fund backed by U.S. Treasuries and repurchase agreements on the Ethereum blockchain.

Accessibility and Compliance

The Diamond Standard Fund is designed to be accessible to a wide array of investors, including pension funds, endowments, and individual retirement accounts (IRAs) in the United States. Adhering to the ERC-3643 token standard, this initiative employs a suite of smart contracts for the issuance, management, and transfer of permissioned tokens, ensuring a high level of security and compliance for participants.

Transforming the Diamond Industry with Blockchain

John Wu, president of Ava Labs, the organization behind the Avalanche ecosystem, praised the venture, saying, “Tokenizing diamonds and offering exposure through a fund structure on Avalanche is a great example of how blockchain can bring transparency and efficiency to an asset class that was previously opaque and inaccessible for institutions.” This sentiment echoes the broader potential of blockchain technology to revolutionize asset management and investment, making previously illiquid or inaccessible assets available to a global audience.

As the Diamond Standard Fund makes its debut on the regulated Oasis Pro Markets, it represents a significant step forward in the intersection of traditional finance and blockchain technology. This venture not only opens up a $1.2 trillion natural resource to investors but also sets a precedent for the future of asset tokenization and investment.