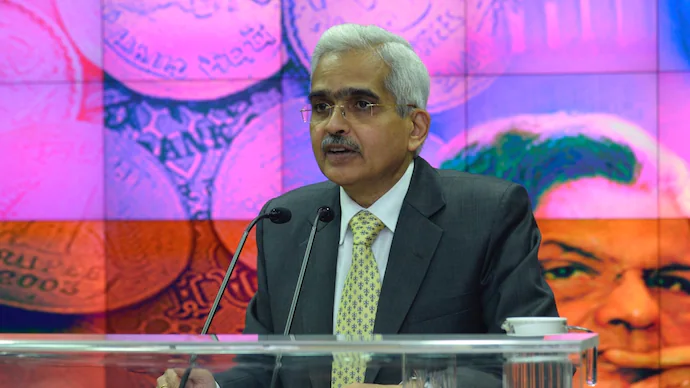

Shaktikanta Das, governor of the Reserve Bank of India, while speaking at an India Today event, referred to cryptocurrencies as “nothing but gambling.” He said, “Crypto is not a financial product; it has no inherent value.” Das argued that banks must take precautions to avoid being absorbed by big tech, which dominates most digital transactions. The governor declared that anything without any foundation and whose value is solely based on conjecture is nothing more than pure speculation, or, to put it bluntly, gambling.

Das stated, “Since gambling is not allowed in our country, if you want to allow it, treat it as gambling and establish gambling regulations.” However, cryptocurrency is not a financial product, according to Das.

RBI recently launched its own digital currency (central bank digital currency), in the form of e–rupee on a pilot basis, first for the wholesale in late last October and a month later for retail customers. The RBI’s e-rupee, a central bank digital currency, is seen as a key development in the Indian financial sector.

Das made a similar claim in December during one of his interviews, predicting that the next financial crisis will be caused by crypto currencies. While Das may not view cryptocurrencies as financial products, he still sees the potential for them to cause economic harm. As RBI Governor, Das has been a vocal critic of cryptocurrencies. He has expressed his concerns over the potential misuse of cryptocurrencies, such as money laundering and tax evasion, as well as their potential to destabilize the economy.