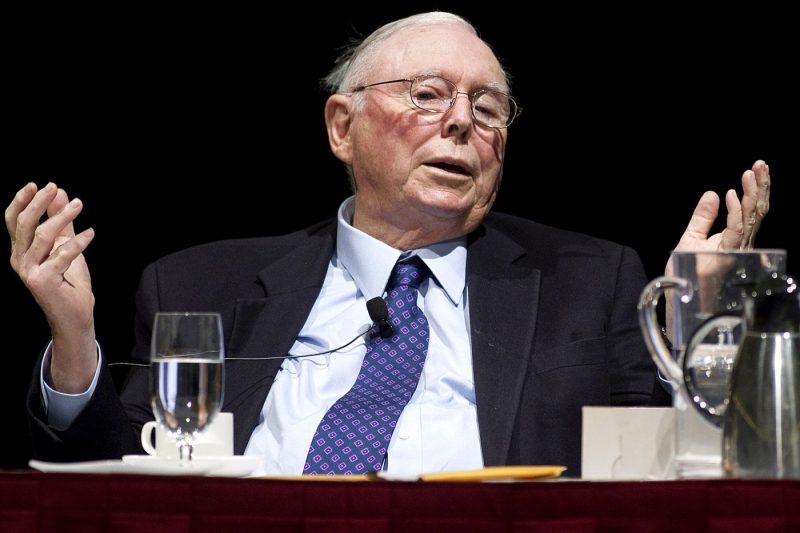

Berkshire Hathaway Vice Chairman, Charlie Munger, has called for the US government to ban cryptocurrencies, following the lead of China. In an op-ed published in The Wall Street Journal, the 99-year-old investor argued that a lack of regulation has led to “wretched excess” and a gambling mentality.

Why Ban Cryptocurrencies?

Munger stated that cryptocurrencies are not a currency, commodity, or security, but rather a “gambling contract with a nearly 100% edge for the house.” He believes that the US should enact a federal law to prevent this issue and prevent people from being taken advantage of.

Read More: Crypto intermediaries should be regulated, says SEC chairman

Cryptocurrency Skepticism

Munger and his business partner, Warren Buffett, have been skeptical of cryptocurrencies for a long time. They believe that cryptocurrencies are not tangible or productive assets. The recent problems in the crypto industry, including failed projects and a liquidity crunch, have only strengthened their stance.

The cryptocurrency market lost over $2 trillion in value last year, with bitcoin, the largest cryptocurrency, dropping 65% in 2022. Despite a rebound of 40%, the price of bitcoin still remains volatile.

Munger believes that two precedents could guide the US towards a ban on cryptocurrencies. First, China has strictly prohibited services related to virtual currencies, including trading and token issuance. Second, the English Parliament banned public trading in new common stocks for about 100 years, starting in the early 1700s.

Munger believes that a ban on cryptocurrencies in the US would be a sound decision. He suggests that after the ban, the US should thank the Chinese Communist leader for their “splendid example of uncommon sense.” By taking action, the US can protect its citizens and prevent the exploitation that has become all too common in the crypto industry.