Bitcoin miners have a chance to significantly boost their profitability by reallocating some of their energy capacity towards the growing sectors of artificial intelligence (AI) and high-performance computing (HPC), according to a report from investment firm VanEck. The firm projects that such a shift could generate up to $13.9 billion in additional annual revenue by 2027.

Why AI and HPC are Lucrative for Bitcoin Miners

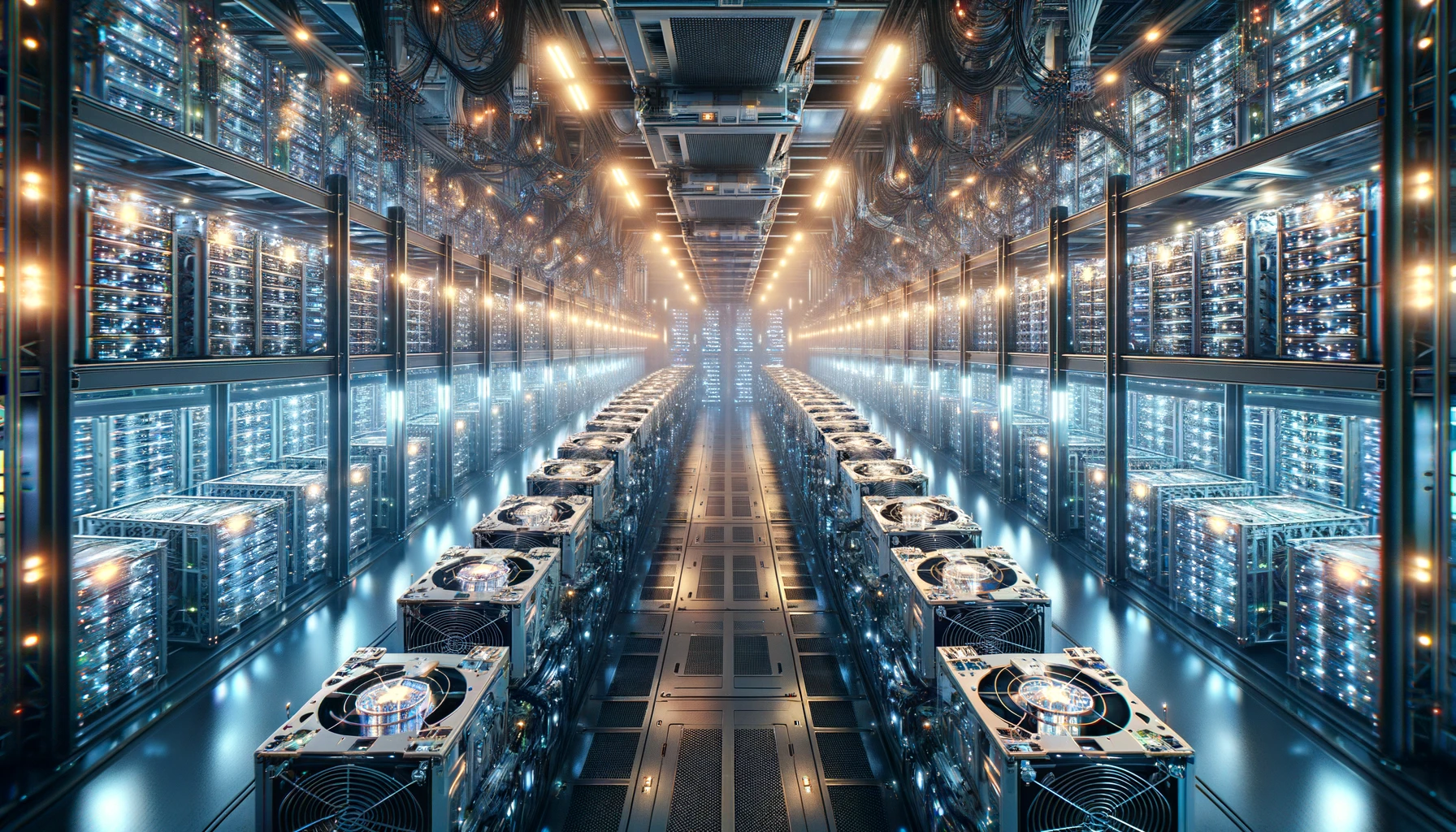

VanEck’s report, released on August 16, highlights the strategic advantage Bitcoin miners have due to their substantial energy resources. “AI companies need energy, and Bitcoin miners have it,” VanEck noted, suggesting that the volatility of Bitcoin prices and operating costs could be mitigated by diversifying into AI and HPC markets.

Bitcoin miners, often grappling with financial instability due to high debt levels, excessive share issuance, and executive compensation, could see marked improvements in their balance sheets by tapping into these emerging sectors. VanEck estimates that if publicly traded Bitcoin mining firms diverted 20% of their energy capacity to AI and HPC by 2027, the cumulative additional profits could average $13.9 billion annually over 13 years.

Early Adopters and Strategic Partnerships

This potential shift aligns with moves already being made by leading Bitcoin miners. Core Scientific, currently the fourth largest Bitcoin miner by hash rate, has secured a 12-year contract with AI hyperscaler CoreWeave. This partnership is expected to generate over $3.5 billion in revenue by supplying 200 MW of infrastructure. Similarly, Canadian miner Hive Digital Technologies has been expanding its facilities to cater to the HPC needs of companies in the gaming, AI, and graphics rendering industries, as detailed in its Q4 2023 report.

The Industry’s Struggles and the Road Ahead

The VanEck report arrives at a challenging time for Bitcoin miners, following the recent Bitcoin halving in April, which reduced mining rewards from 6.25 BTC to 3.125 BTC per block. This halving has exacerbated existing financial pressures on miners, as highlighted by Marathon Digital’s disappointing Q2 revenue of $145.1 million, which fell short of analysts’ expectations.

The viability of the Bitcoin mining industry has been under scrutiny, with firms like Kerrisdale Capital criticizing it as an “industry of snake oil salesmen” due to unsustainable business models that rely on constant share dilution without delivering returns. In contrast, VanEck’s proposal offers a path for miners to stabilize and even enhance their profitability by embracing the growing demand for AI and HPC energy resources.