Bitcoin’s recent rally to near-record highs may be at a crossroads, according to 10X Research. The firm points to the next couple of days as a critical period for Bitcoin, with ETF inflows serving as a litmus test for the cryptocurrency’s immediate price direction. Despite achieving all-time highs of approximately $74,000 last week, Bitcoin experienced a downturn, raising questions about the sustainability of its recent gains.

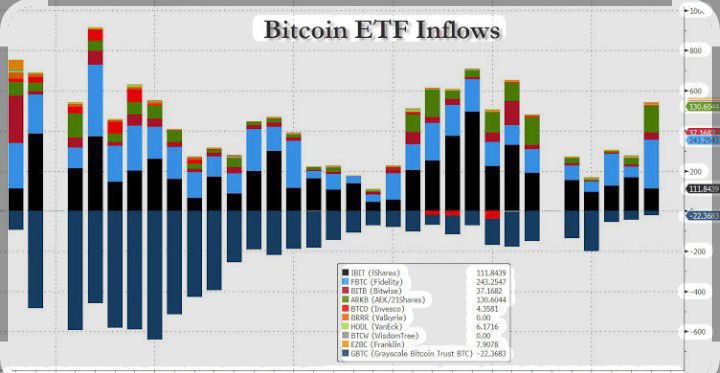

Record ETF Inflows Last Week

U.S.-listed spot Bitcoin ETFs witnessed unprecedented inflows, drawing $2.6 billion in the week ending March 15. This surge in investment played a pivotal role in propelling Bitcoin’s value. However, as the week progressed, inflows began to diminish, with Thursday and Friday seeing significantly lower figures. This slowdown coincided with a sharp decline in Bitcoin’s price to below $65,000 over the weekend.

The Forecast Ahead

Markus Thielen of 10X Research notes that Monday and Tuesday will be crucial in determining Bitcoin’s next move. A continuation of the slowdown in ETF inflows could signal the start of a deeper correction, potentially bringing Bitcoin’s price down to as low as $59,000. Despite this potential downturn, Thielen remains optimistic about Bitcoin’s prospects, suggesting that a rebound above $70,000 could trigger a significant rally.

Bull Market Not Over Yet

The analysis by 10X Research counters the more bearish narratives, suggesting that the bull market for Bitcoin is far from over. With Standard Chartered recently revising its year-end price target for Bitcoin to $150,000 and anticipating a high of $250,000 by 2025, the long-term outlook for Bitcoin remains bullish.

As the cryptocurrency community watches closely, the performance of Bitcoin ETFs in the coming days will likely play a pivotal role in shaping the short-term trajectory of the world’s largest digital asset.