Institutional Adoption Could Drive Bitcoin’s Massive Price Surge

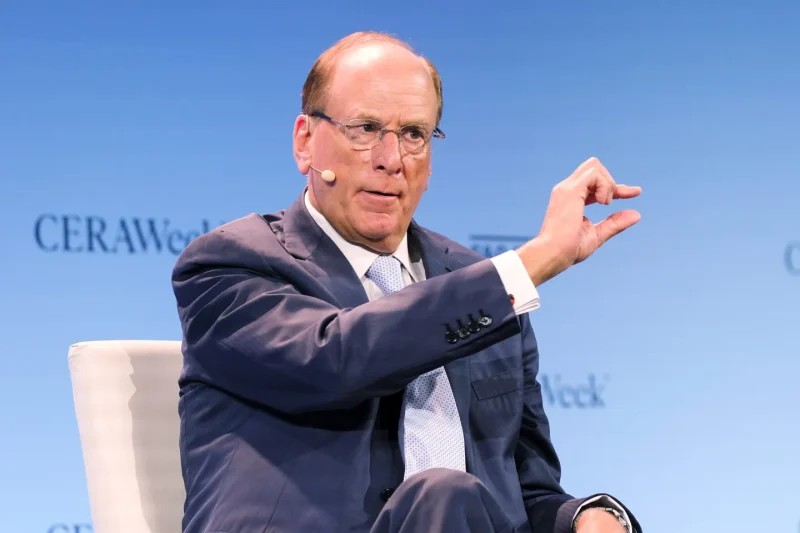

In a bold projection that’s turning heads across both Wall Street and the crypto world, BlackRock CEO Larry Fink believes Bitcoin could soar to valuations between $500,000 and $700,000. The catch? It hinges on widespread institutional adoption—particularly if sovereign wealth funds allocate just a small portion of their portfolios to the digital asset.

Speaking at the World Economic Forum in Davos, Fink revealed that several sovereign wealth funds are now seriously considering Bitcoin allocations ranging from 2% to 5%. “I was with a sovereign-wealth fund during this week,” Fink noted. “There was a conversation: should we have a 2% allocation? Should we have a 5% allocation? If everybody adopted that conversation, it would be $500,000…”

This marks a dramatic shift in tone from Fink, who was previously skeptical of cryptocurrencies. Now, under his leadership, BlackRock has launched both the iShares Bitcoin Trust and iShares Ethereum Trust, indicating growing institutional confidence in digital assets.

Bitcoin as a Hedge Against Uncertainty

Fink also emphasized Bitcoin’s value beyond its price, calling it an “internationally based instrument” that can serve as a hedge against currency debasement and geopolitical instability. As more institutions grapple with economic uncertainty and inflation risks, Bitcoin is gaining traction as a long-term store of value.

As of January 22, 2025, Bitcoin was trading near $103,998, slightly down from its recent peak of $109,225. Despite this volatility, Fink’s comments have reignited optimism, especially among investors betting on Bitcoin’s long-term institutionalization.

Institutional Momentum Is Building

Fink isn’t alone in highlighting the potential impact of institutional interest. Coinbase CEO Brian Armstrong recently mentioned that multiple finance ministers are exploring the idea of holding strategic Bitcoin reserves—a move that could further validate Bitcoin as a core financial asset.

Key drivers of institutional adoption include:

- Growing distrust in traditional monetary systems

- The rise of digital-native investment strategies

- Increasing regulatory clarity in major markets

- Enhanced infrastructure for custody and compliance

However, Fink was quick to temper expectations, noting that while the upside potential is real, Bitcoin remains a highly volatile asset. His projection isn’t an outright endorsement but rather a view of what could happen if institutional adoption plays out on a global scale.

Larry Fink’s shift in stance is a telling sign of Bitcoin’s maturing reputation in traditional finance. While his projection of $500,000 to $700,000 isn’t guaranteed, it reflects the growing belief that Bitcoin could become a foundational asset in the portfolios of institutional investors worldwide.

As digital assets continue to integrate into the global financial system, Bitcoin’s role may evolve significantly—offering substantial opportunity, but also requiring careful risk management.