Bitcoin payment application Strike, helmed by entrepreneur Jack Mallers, is widening its horizons with an expansion into 65 worldwide markets. This move comes in addition to its existing presence in the United States, Argentina, and El Salvador.

Strike Offers “Frictionless Onboarding”

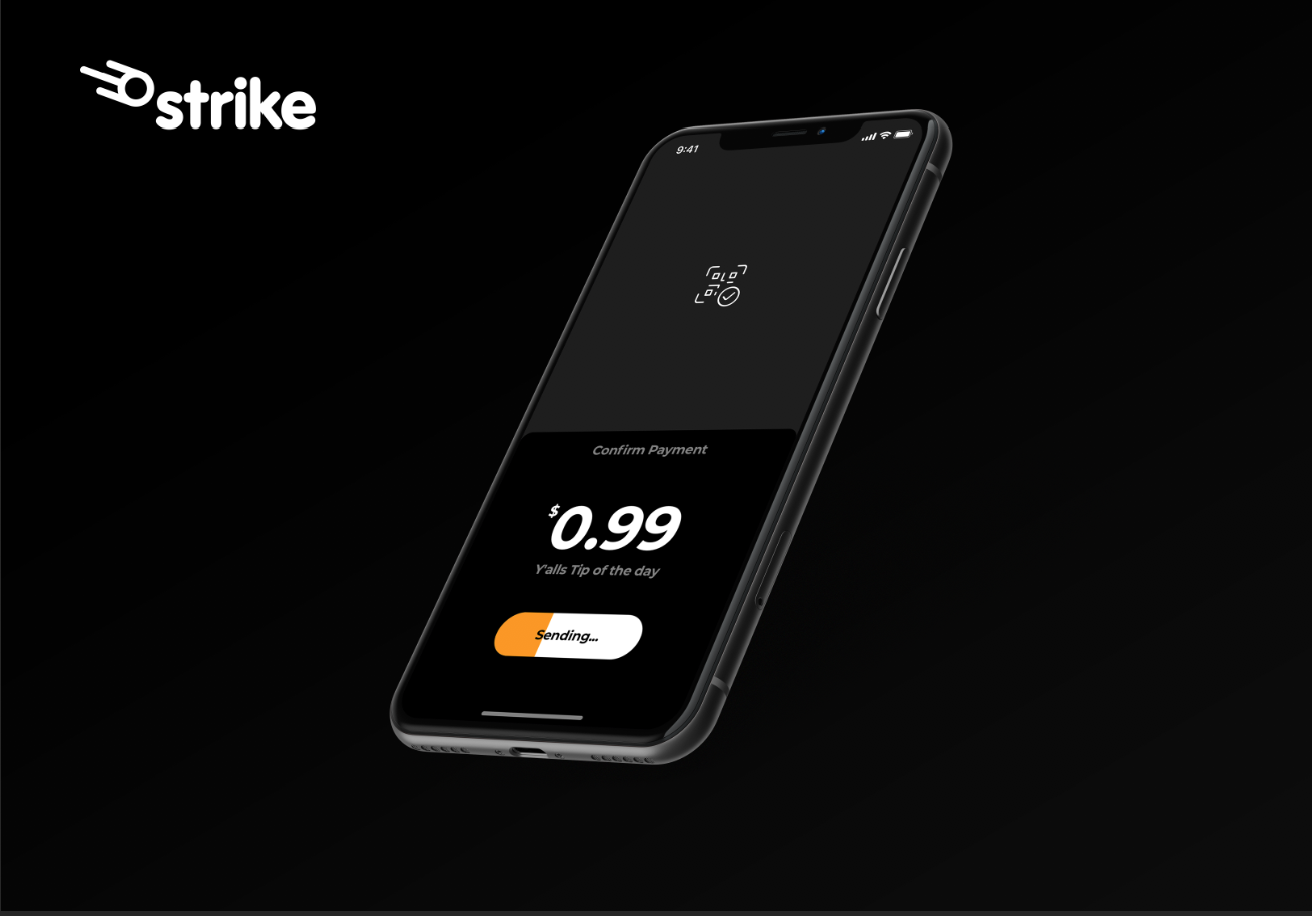

Mallers highlighted Strike’s user-friendly app that enables Bitcoin and Tether transfers through a process he calls a “frictionless onboarding.” The CEO expressed his confidence in the appeal of a financial app with such functionalities and accessibility, as opposed to the complexity of crypto exchanges and countless different coins.

While the U.S. crypto industry grapples with regulatory uncertainty, Strike’s Bitcoin-centric approach stands out. Mallers asserts that Bitcoin, with its decentralized nature and lack of ownership, stands apart from other crypto instruments that typically have founding teams and foundations.

Also Read: Strike Expands to the Philippines to Boost Cross-Border Payments

Strike’s Regulatory Compliance and Expansion

Strike takes a proactive stance on regulation, working to obtain necessary permissions in markets such as New York. It’s important to note that the company is currently pursuing a BitLicense in the state.

This growth into global markets has been partly facilitated by Strike’s move to El Salvador. The nation has recently passed a digital assets law, providing a regulatory framework for crypto operations. Strike was among the first companies to receive a license under this new system.

Addressing the Challenges

Strike faces a significant task in extending its banking services connections to allow customers to convert Bitcoin to traditional currencies. At present, users in Strike’s new markets can only receive Bitcoin from other users. Mallers aims to launch new functionalities, like a debit card, later this year, despite potential challenges such as network congestion and higher transaction fees due to increased demand for new products like ordinals and BRC-20 tokens.

Another feature to note is Strike’s Send Globally, enabling users to transfer between USD and other currencies using Bitcoin as a go-between. Currently, this service is limited to twelve countries across Africa, Central America, and Southeast Asia.

Tether as the Choice Stablecoin

Strike’s dollar balances are held in Tether, a stablecoin pegged to the dollar. Despite criticisms over its opaque accounting practices, Tether was chosen over alternatives like Circle and Coinbase’s USD Coin, primarily due to its popularity among users in the Global South.