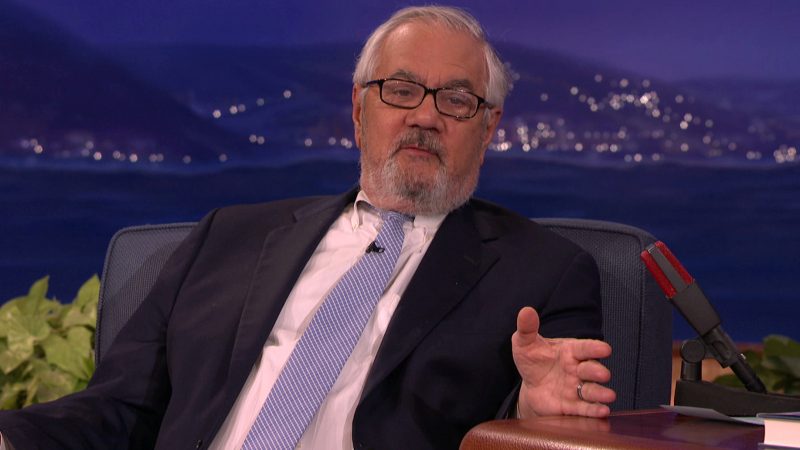

Barney Frank, the former congressman and a board member of Signature Bank, has accused regulators of closing down the bank to send an “anti-crypto message.” Signature Bank, the third-largest bank failure in U.S. history, was closed down by New York regulators on Sunday citing system risk. The sudden decision took management at the firm by surprise. Frank, one of the people behind the Dodd-Frank Act, believes that regulators targeted the bank to attack the digital asset industry, as it was the “poster boy” for the crypto industry.

Background Information

The move comes after Silicon Valley Bank collapsed after a $42 billion bank run days before, to which many crypto companies had exposure. Similarly, Silvergate, which was also crypto-friendly, announced it was winding down operations. Signature Bank was popular among crypto companies as it gave them loans. For instance, Coinbase held a corporate cash balance of around $240 million, while Paxos held $250 million at Signature Bank.

Also Read: Crypto intermediaries should be regulated, says SEC chairman

Regulatory Intervention

Signature Bank’s closure means that mainstream crypto companies are once again locked out of the traditional finance system. This development will negatively affect crypto exchanges, which require access to the traditional finance system for their customers to buy assets like Bitcoin and cash out to US dollars. The intervention to protect depositors, known as the systemic risk exception, has been described by The Wall Street Journal as a de facto bailout of the banking system.

Frank believes that the regulators’ actions could have a significant impact on the crypto industry, as they are sending an anti-crypto message. The closure of Signature Bank will force crypto companies to look for other alternatives to the traditional finance system. While regulators have not provided any further reasoning for shuttering the bank, the move may have been a warning shot to the crypto industry.